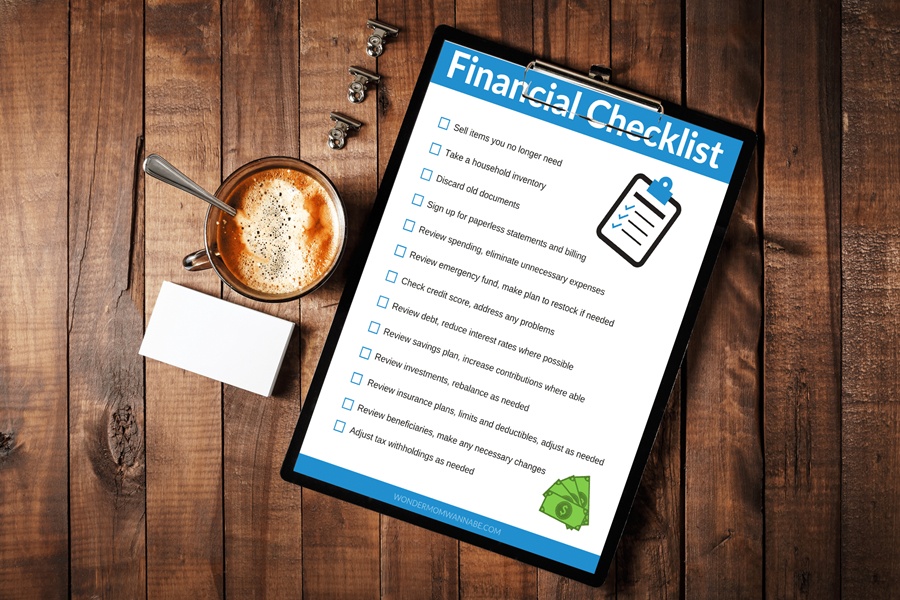

1. Create A Budget: This is one of the most important steps when it comes to taking control of your finances. Without a budget, it can be hard to keep track of where your money goes and how much money you’re actually spending each month. Creating a budget can help you identify areas that need improvement, such as reducing unnecessary expenses or setting aside more money for savings or investments.

2. Establish An Emergency Fund: Emergencies happen—that’s a fact we all have to accept—so having an emergency fund ready is essential for maintaining financial stability in case something unexpected arises. Start by setting aside small amounts each month until you are able to build up enough funds for at least six months’ worth of living expenses including rent/mortgage payments, food costs, and other necessary items like utilities and insurance bills.

3. Pay Off Debt: If possible, try to pay off any high-interest debt first as this will save you money in the long run on interest payments over time. Additionally, if there are multiple debts with different interest rates then prioritize paying off those with higher rates since they cost more in the end overall due to their compounded interest fees over time compared with lower-interest debt options (like student loan debt).

4 . Invest For Retirement: The sooner you start investing for retirement the better; even if it’s just small amounts per month initially – every penny counts! When considering where best to invest your funds consider diversifying into different asset classes such as stocks & bonds which will provide greater potential returns than simply cash accounts alone due to their ability to generate dividends or capital gains over time depending on market conditions at any given moment which also makes them less risky investments than some other alternatives out there today (e..g cryptocurrencies etc.).

5 . Monitor Your Credit Score: Monitoring your credit score regularly is essential because changes in credit scores could mean increased interest rates when taking out loans or even rejections from lenders altogether if they deem someone’s score too low – not ideal! So make sure that yours stays within an acceptable range by checking it regularly online via websites like Experian or Equifax which offer free monthly updates on scores plus helpful advice about how best to manage credit responsibly going forward to boot!

6 . Review Insurance Policies Regularly: Insurance policies should be reviewed annually (or semi-annually) so that any changes occurring in our lives can be accommodated accordingly ensuring optimal coverage throughout life events like getting married having children starting businesses etc.. Doing this also helps ensure policyholders aren’t paying premiums unnecessarily due to a lack of understanding of what exactly is covered under their current plan or not – always double-check policies before signing them off!

Taking care of our finances doesn’t have to be complicated; following these simple steps will give anyone peace of mind knowing they’re making smart decisions regarding their money while also protecting future well-being from unexpected events down the line…so don’t delay take action today and get started now!