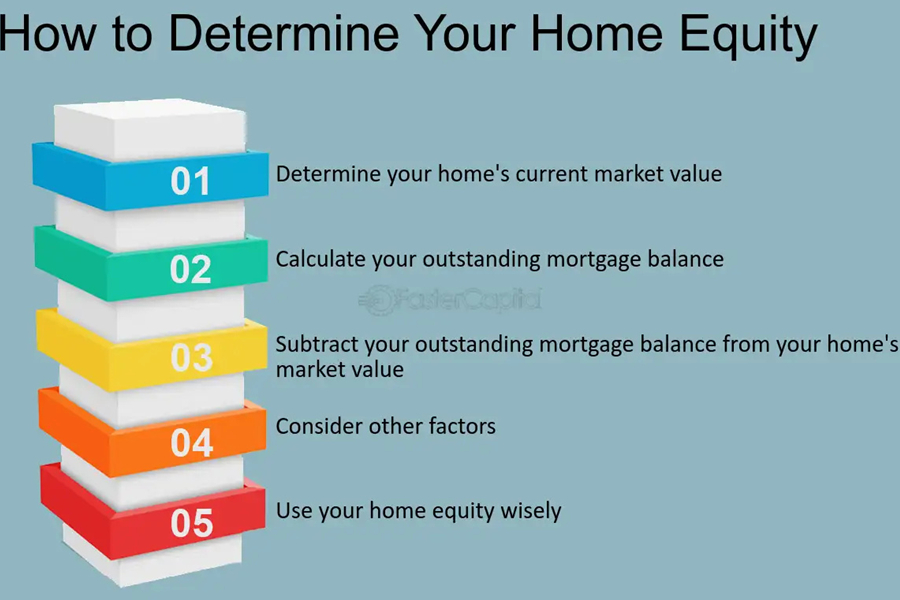

The first step in unlocking the potential of your home equity is to find out what it’s worth. This can be done by getting an appraisal or speaking with a real estate agent who can provide an estimate based on recent sales data in your area. Once you have an idea of what your home is worth, you’ll want to calculate how much debt you have against it and subtract this from the estimated value to come up with your total available equity.

Once you know how much equity you have available, it’s time to consider ways that it can be used. One popular option for tapping into this wealth generator is through a cash-out refinance loan, which allows homeowners to borrow against their existing mortgage while still keeping their current interest rate intact. Another option for leveraging home equity could be taking out a home equity line of credit (HELOC) which also enables borrowers to access funds without having to pay any closing costs or fees associated with refinancing a mortgage.

Finally, if needed, there are also reverse mortgages available for those aged 62 or older that allow them access to additional funds without any repayment required during their lifetime as long as they continue living in the property as their primary residence. These loans are typically repaid upon sale or death and should only be considered after careful research and consulting with qualified professionals such as financial advisors and attorneys familiar with these types of transactions beforehand.

Knowing exactly how much value lies within one’s home can help unlock its full potential down the road; no matter what route is taken – whether through cash-out refinance loans, HELOCs, or reverse mortgages – being aware of all options available will help guide homeowners towards making decisions best tailored toward meeting financial goals while ensuring satisfactory returns along the way!